[MACRO Trends] Gold bull market continues to be strong: Gold and silver diverge under the prospect of a weaker dollar and a trade agreement

- 2025年5月8日

- Posted by: Macro Global Markets

- Category: News

On Tuesday this week, the gold market continued to rise, with spot gold breaking through $3,385 per ounce at one point, up 1.5% on the day; spot silver also touched $33 per ounce, up 1.66% on the day. Against the backdrop of a weakening dollar and increasing trade policy uncertainty, gold's status as a safe-haven asset has been further strengthened.

The dollar fell against other major currencies, mainly due to market speculation about the progress of a US trade deal. U.S. President Donald Trump said the administration could reach a deal this week. Investors are closely watching the scope and nature of the trade and tariff agreement, especially whether it involves a coordinated effort among global policymakers to further weaken the dollar. Trump's trade policies have weakened the dollar's role as a traditional safe haven, prompting investors to increase allocations to non-U.S. assets.

A weaker dollar not only makes gold more attractive, it also makes it less expensive for buyers of other currencies, further boosting prices. Gold prices have surged more than 25% this year, reaching a record high of $3,500 an ounce in April. By comparison, the Bloomberg Dollar Spot Index is down nearly 7% this year, its biggest drop since its launch. Data from the U.S. Commodity Futures Trading Commission (CFTC) showed that traders in the speculative derivatives market are the most bearish on the dollar since September last year.

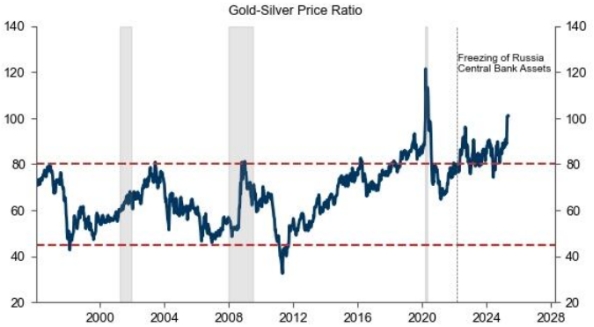

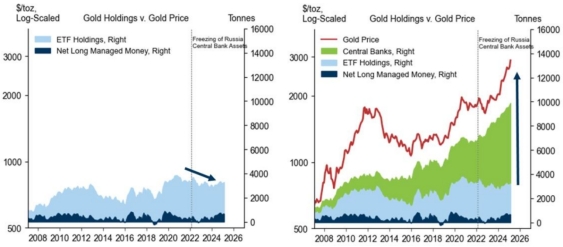

Historically, gold and silver prices have been highly correlated, primarily because their investment flows (such as ETF demand and COMEX net managed fund positions) typically move in tandem. However, since 2022, the gold-silver price ratio has broken through the historical range and is currently maintained at a high point. Goldman Sachs precious metals research team pointed out that the structural growth of central bank gold purchasing demand is a key factor in pushing up gold prices, while silver has failed to receive the same support. After Russia's foreign exchange reserves were frozen, the central bank's gold purchases surged fivefold, but this trend did not extend to silver.

Gold's scarcity, high unit value and stable chemical properties make it more suitable for reserve management, while silver has a lower status among reserve assets due to its abundant reserves, lower value and easy oxidation and deterioration. In addition, silver is not included in the IMF reserve framework, and its industrial attributes cause it to perform poorly in economic downturns, with greater volatility and poorer liquidity. Although silver is supported by industrial demand (such as the photovoltaic boom), it has never been able to narrow the gap with gold. With overcapacity in photovoltaics and rising risks of a US recession, gold is expected to continue to outperform silver, driven by central bank demand for gold.

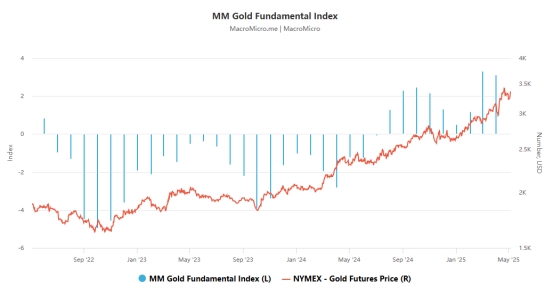

Goldman Sachs reiterated its structural bullish view on gold, predicting that the price will reach $3,700 per ounce by the end of the year and $4,000 per ounce by mid-2026. If U.S. policies trigger a recession, accelerated ETF inflows could push gold prices to $3,880 by the end of the year. In extreme cases (such as the Federal Reserve's policy being questioned or the US reserve policy changing), the gold price may reach $4,500 by the end of 2025. Goldman Sachs believes that now is an attractive entry point for long-term investment in gold.

Although the potential for a deal between Ukraine and Russia could cause a brief 3% drop in gold prices, long-term investors with low leverage can absorb this short-term volatility risk. Goldman Sachs recommends that long-term investors add to their positions on dips, but leveraged investors need to be wary of volatility risks. In comparison, there is little hope for a rebound in silver prices. While silver may benefit from renewed investor interest, its performance is unlikely to mirror that of gold. However, silver may also follow suit when gold investment demand picks up, as shown by the rebound in the first quarter of 2025, when ETF inflows and speculative buying supported both gold and silver.

Galaxy Securities pointed out that gold may need to wait for the Federal Reserve to cut interest rates or an explosion in physical gold demand before it can break out of the range. We need to further observe the economic situation in the United States in the future, whether it is stagflation or recession. If stagflation occurs and the Fed does not cut interest rates, gold will most likely fluctuate upward; if a recession occurs, gold will follow other commodities in a correction until the Fed starts cutting interest rates. Currently, the gold price range has increased to $3,150 to $3,550, and is expected to rise to above $3,700 after the Federal Reserve cuts interest rates.

Analyst Christopher Lewis believes that although it is uncertain how much upside there is, it is not advisable to short in the current environment. The $3,200 level is expected to become a key support level that the market generally pays attention to. Overall, gold is in a bullish pattern, and the market generally regards gold as an ideal target for "buying on pullbacks." This trading logic has continued to dominate the gold market for a long time and is still continuing.

In the current market environment, gold is undoubtedly an important part of investors' asset allocation. For long-term investors, adding to gold positions on dips is an attractive strategy, but be wary of short-term volatility risks. As for silver, although it may rise along with gold during certain periods, the possibility of an overall compensatory rally is low, and investors need to be cautious.

Market participants should pay close attention to U.S. trade policy developments, economic data releases and the Federal Reserve's policy direction. These factors will largely determine the future trend of gold prices. Although there may be fluctuations in the short term, in the long run, the value of gold as a safe-haven asset is still recognized by the market.