New focus on energy landscape: EU lowers Russian oil price ceiling and US reduces Saudi Arabian crude oil imports

- 2025年1月16日

- Posted by: Macro Global Markets

- Category: News

Recently, there have been two significant changes in the global energy market: first, six EU countries called on the Group of Seven to lower the price ceiling for Russian oil; second, the amount of crude oil imported by the United States from Saudi Arabia has dropped to the lowest point in nearly 40 years. These two events not only reflect the dynamic adjustments in the energy market, but also reveal profound changes in the geopolitical landscape.

Sweden, Denmark, Finland, Latvia, Lithuania and Estonia jointly wrote to the European Commission, calling for a reduction in the $60 per barrel price cap set by the Group of Seven for Russian oil. These countries believe that lowering the price ceiling will further reduce Russia's oil export revenues, thereby weakening its financial support in the Russo-Ukrainian conflict, while not causing a shock to the market.

Since the price cap was implemented in December 2022 and February 2023, the average market price of Russian crude oil has been below this cap. In the letter, the six EU countries pointed out that the current supply situation in the international oil market is good, and the risk of supply shock caused by lowering the price ceiling of Russian oil has been significantly reduced. Moreover, it would be difficult for Russia to stop exporting oil even if the price ceiling was significantly reduced, given its limited storage capacity and over-reliance on energy export revenues.

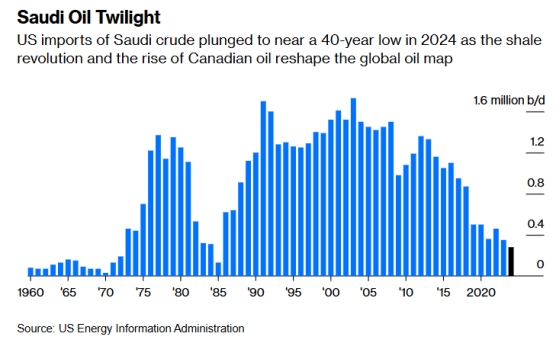

The US shale revolution and the rise of the Canadian oil industry are the main reasons for the decline in imports. The three largest U.S. refiners - Marathon Oil Corp., Valero Energy Inc. and Exxon Mobil Corp. - have all stopped importing Saudi crude over the past two years or so. Exxon’s last purchase of Saudi crude was through November 2023, a sign that the companies did not renew their long-term contracts, ending a decades-long relationship.

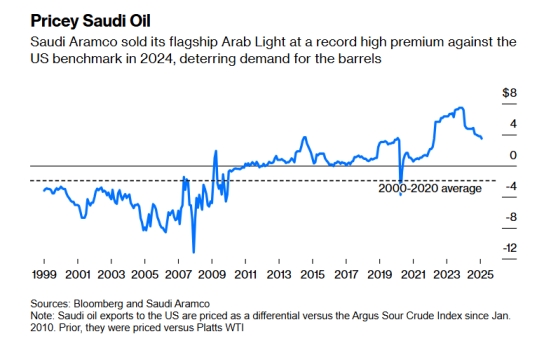

Riyadh set the premium for its flagship export oil product, Arab Light, at $5 a barrel above the U.S. sales reference price for most of 2023 and 2024, well above historical levels. Saudi Arabia uses its official selling prices as a tool to reduce the kingdom’s oil inventories, which are closely watched by traders, by reducing flows into the United States. Therefore, low Saudi Arabia-US flows became part of the OPEC+ production cuts. Although these two events seem independent, they are actually two aspects of changes in the global energy landscape. On the one hand, the six EU countries called for a reduction in the price cap of Russian oil, reflecting Europe's efforts to diversify energy supplies and reduce dependence on Russian energy.

The call by six EU countries to lower the price cap on Russian oil and the US to reduce Saudi crude oil imports reflect the dual changes in the global energy landscape. These changes not only affect the supply and demand relationship in the international energy market, but also have a profound impact on the geopolitical strategies of relevant countries. As energy markets continue to adjust, countries will continue to seek a balance between energy security and geopolitical interests, pushing the global energy landscape toward a more diversified and stable direction.