Putin's plane was besieged by 46 drones! The conflict between Russia and Ukraine escalates

- 2025年5月27日

- Posted by: Macro Global Markets

- Category: News

On May 25, Dashkin, commander of the Kursk Air Defense Division of Russia, disclosed for the first time: When Putin inspected the front line on May 20, the Ukrainian army dispatched 46 drones to "precisely besiege" the presidential helicopter route, and the Russian army shot down all targets within a radius of 20 kilometers. The Russian side accused the attack of "intelligence accurate to the minute" and suspected internal leaks, while the Ukrainian side denied planning the assassination, saying that "drones only target military targets."

Three signs of escalating conflict:

Russian retaliatory bombing: On May 25-26, the Russian army launched a joint attack on Kiev using "Shahed drones + Dagger missiles", destroying three energy facilities and setting residential areas on fire. The Ukrainian Air Force confirmed that this was the "largest air strike in a single day" since the 2022 conflict, with a record 367 attacks.

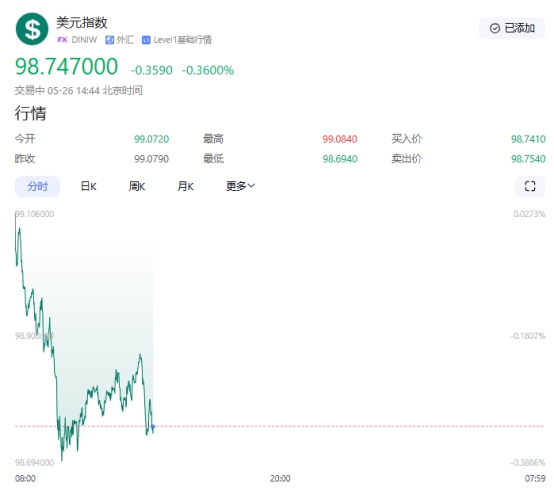

Change in Western attitude: The US NPR admitted that "the scale of the attack shocked Washington", and the Trump administration suspended peace talks and considered additional sanctions against Russia. On the 26th, the European Union announced the 19th round of sanctions against Russia, freezing the assets of 127 officials.

The battlefield situation reversed: the Russian army took advantage of the situation and advanced, announcing on the 26th that it had occupied three settlements in Donetsk and established a "drone defense buffer zone." Ukrainian think tank ISW assessed: "Putin is expanding the occupied territories in the east in the name of 'protecting the homeland'."

2. Gold market: a “nuclear explosion” reaction to geopolitical risk premium

1. The demand for safe havens surged instantly

1. The demand for safe havens surged instantly

Historical data shows that for every escalation of the Russia-Ukraine conflict (such as an attack on the leader), the average 24-hour increase in gold prices is 1.8%. This incident may push the gold price to break through $3,380.

2. De-dollarization accelerates support

The Russian Central Bank announced on the 26th that it would increase the proportion of gold in its foreign exchange reserves to 28%, a record high. China's gold imports in April were 127.5 tons (up 73% year-on-year), and continued to increase to 2,294 tons. The World Gold Council pointed out: "Geopolitical risks have forced central banks to accelerate 'de-dollarization', and global central bank gold purchases may exceed 1,300 tons in 2025."

3. Trend Outlook: From “Local Conflict” to “Systemic Crisis”

The attack on Putin's private plane marks the entry of the Russia-Ukraine conflict into the sensitive period of "leadership security", and the safe-haven value of gold has been upgraded from "regional conflict" to "global governance crisis." U.S. Treasury yields fell to 4.518% on the 26th, reflecting market concerns about "conflict spillover" - if NATO directly intervenes, gold may break through $3,500.