Global risk aversion heats up, gold market is in turmoil again

- 2025年4月7日

- Posted by: Macro Global Markets

- Category: News

[MACRO Sharp Comments] Global risk aversion heats up, and the gold market is in turmoil again

1. Tariff policy and geopolitical risks

The Trump administration's tariff policy and global geopolitical tensions have become the direct reasons for the rise in gold prices. The economic uncertainty caused by the tariff policy has led investors to seek safe-haven assets, with gold becoming the first choice.

2. Central bank gold buying spree

The continued increase in gold holdings by central banks around the world is an important driving force behind the rise in gold prices. Over the past four years, global official gold reserves have increased by $725 billion, while U.S. dollar reserve assets have declined. The "weaponization" trend of the US dollar has forced countries to re-examine their foreign exchange reserve structure, and gold has become the main beneficiary.

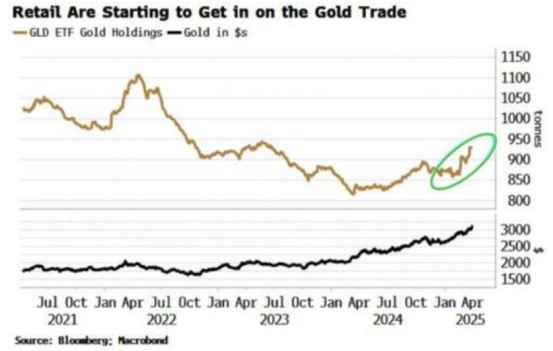

3. Double push from retail and institutional investors

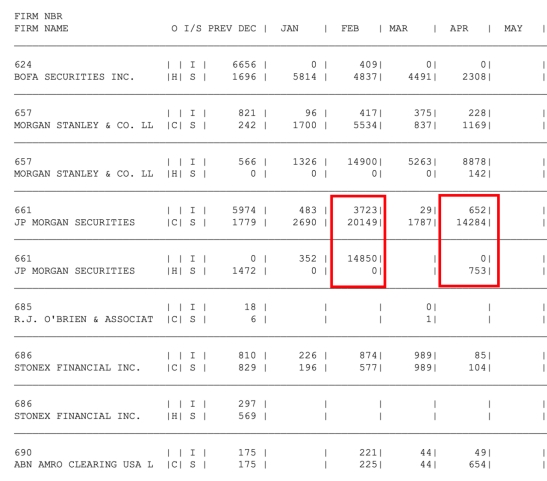

The participation of retail investors has increased significantly, and the holdings of the world's largest gold ETF-GLD have increased significantly recently. At the same time, Wall Street giants such as JPMorgan Chase and HSBC are also frantically hoarding physical gold, further pushing up gold prices.

Recently, the delivery volume in the COMEX gold and silver markets has hit an all-time high, showing strong demand for physical metals in the market. From December 2023 to March 2024, in just four months, the COMEX gold delivery volume was close to 450 metric tons, while the silver delivery volume reached 5,050 metric tons. This abnormal delivery demand suggests that there may be undisclosed uncertainties in the market, further exacerbating investors' concerns about the gold market.

1. Gold stocks surge

COMEX gold inventories have rapidly climbed from 17.1 million ounces in November 2023 to 43.3 million ounces (about US$135 billion), a record high. At the same time, gold reserves in the London vault continue to flow out, mainly to central banks in emerging market countries.

2. Synchronous movement in the silver market

The delivery volume in the silver market has also surged abnormally, with the delivery volume in the first four months of 2024 far exceeding the full year level of 2023. This phenomenon shows that the overall demand in the precious metals market is rapidly heating up.

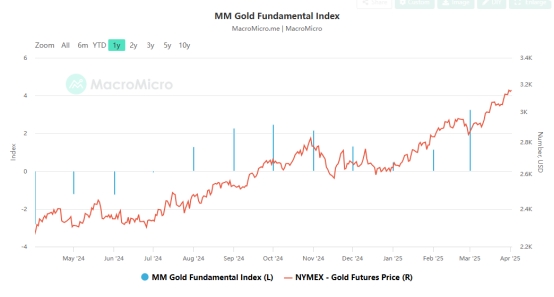

3. Pricing Misalignment and Market Distortion

The tariff policy has widened the price gap between COMEX futures and London spot gold, leading to pricing misalignment in the market. The surge in COMEX inventories contrasted sharply with the outflow from London inventories, further exacerbating market concerns about gold supply imbalances.

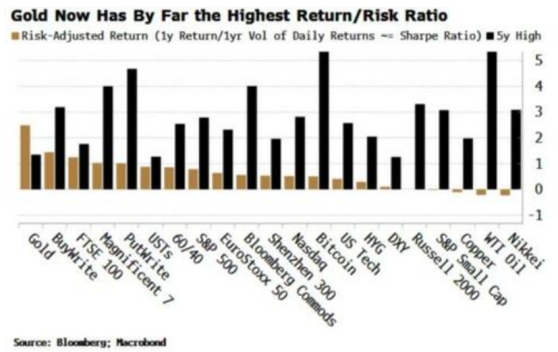

Although gold prices have performed strongly recently, the market also faces potential risks and uncertainties.

1. Overbought risk and pullback pressure

The rapid rise in gold prices has brought it into the overbought zone, and a deep correction may occur in the short term. Historical data shows that gold's long-term compound annual return is approximately 4.92% per decade, which means that current excess returns may foreshadow future price adjustments.

2. Suspicion of market manipulation

The abnormal delivery demand in the COMEX market and the gold hoarding behavior of Wall Street giants have triggered market speculation about potential manipulation. Investment banks such as JPMorgan Chase hedged their short positions through physical delivery, which may have affected the trend of gold prices to some extent.

3. Uncertainty in the global financial system

Against the backdrop of a changing global financial system, the fundamental reasons for gold’s status as a safe-haven asset remain. However, investors need to be wary of sudden shifts in market sentiment and the dramatic price fluctuations that may result.

Behind the prosperity of the gold market, there is both the safe-haven demand driven by global economic uncertainty and the potential risks brought about by changes in market structure. In this complex market environment, investors need to remain rational and pay close attention to changes in policy developments and market sentiment in order to respond to possible price fluctuations. Whether as a safe-haven asset or an investment tool, the future trend of gold is still full of variables and deserves continued attention.