[MACRO Sharp Comment] Japan cuts interest rates and reduces debt + oil price is $85, can your US stock holdings withstand it?

- 2025年6月19日

- Posted by: Macro Global Markets

- Category: News

[MACRO Sharp Comment] Japan cuts interest rates and reduces debt + oil price is $85, can your US stock holdings withstand it?

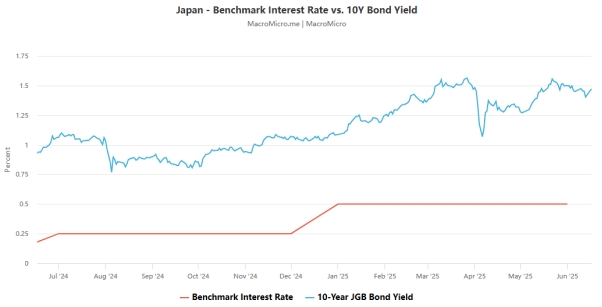

On June 17, the Bank of Japan announced that it would maintain its target interest rate at 0.5%, keeping its monetary policy unchanged for the third consecutive time, in line with market expectations. The bank voted 8 to 1 to extend the existing bond reduction plan until March 2026, reducing the purchase of government bonds by about 200 billion yen per month from April 2026, until the monthly purchase scale is reduced to about 2 trillion yen from January to March 2027.

The policy statement pointed out that the Japanese economy as a whole is showing a moderate recovery trend, with exports and industrial production remaining flat, equipment investment growing moderately due to improved corporate profits, and private consumption remaining resilient amid an improved employment environment, but residential investment is weak. In terms of prices, the core CPI rose by about 3.5% compared with the same period last year, mainly affected by the transmission of wage increases and food prices (such as rice), but as the factors of import prices and food price increases weaken, core inflation is expected to be sluggish in the short term, and gradually approach the price stability target in the medium and long term as the economy recovers. The Bank of Japan emphasized that it will reduce government bond purchases in a predictable manner while retaining flexibility to maintain market stability. If long-term interest rates rise rapidly, it will respond by increasing purchases or fixed interest rate operations.

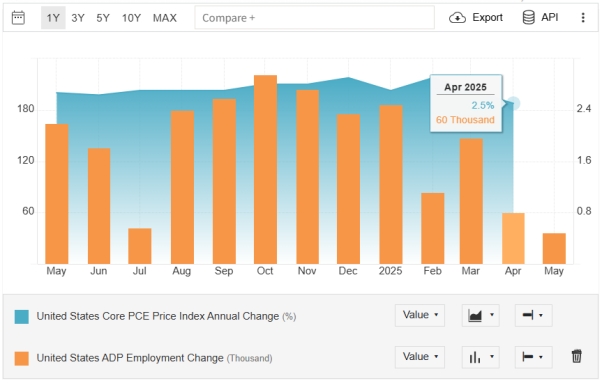

2. Expectations of the Fed remaining on hold rise, and concerns about policy lags loom

The market generally expects the Fed to keep interest rates unchanged at its meeting early Thursday morning, and the implied probability of CME interest rate futures has soared to 99.3%. However, the core PCE price index is still hovering at a high of 3.2% compared with the same period last year, which is still significantly away from the Fed's inflation target of 2%. Atlanta Federal Reserve Chairman Bostic recently publicly stated that it will take at least three consecutive quarters of core inflation below 2.5% before considering adjusting monetary policy. It is worth noting that the current geopolitical risks continue to ferment: the United States' new round of tariff lists on China's semiconductor industry chain is about to be implemented, and the conflict between Iran and Israel has caused Brent crude oil futures prices to hit a nearly 18-month high. The Fed is caught in a dilemma between "fighting inflation" and "preventing recession". US President Trump even sent three tweets on social media, accusing Powell of "economic suicide by sticking to high interest rates". This political intervention has further exacerbated policy uncertainty.

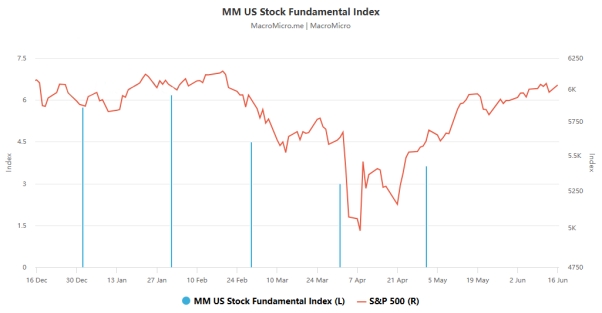

3. As the conflict between Iran and Israel escalates, US stocks face a triple risk test

Royal Bank of Canada (RBC) pointed out that the conflict between Iran and Israel may drag down the U.S. stock market through three major channels:

Valuation risk: When geopolitical uncertainty rises, the S&P 500 P/E ratio tends to shrink. The current stock price is close to a record high, and the valuation did not fall to the "cheap" range during the tariff crisis in April, and it is highly sensitive to negative news.

Market sentiment is dampened: The escalation of tensions in the Middle East could reverse the recent improvement in investor sentiment. Businesses and consumers have become cautious - CEO confidence fell to a three-year low in the second quarter, consumers are still concerned about tariffs and extreme weather, and the frequency of mentioning geopolitics in earnings conference calls has increased.

Surging oil prices push up inflation: If the conflict leads to supply disruptions in the Middle East, oil prices may rise further. RBC expects core PCE inflation to rise to 4%, suppressing the Federal Reserve's room for interest rate cuts in 2025 (possibly only twice), which in turn will hit stock market valuations that rely on expectations of rate cuts.

Conclusion

At present, the global financial market is deeply trapped in the complex dilemma of monetary policy differentiation and geopolitical risks: the Bank of Japan has gradually reduced the YCC yield curve control policy against the backdrop of a mild recovery in domestic consumption and core inflation above 2% for 19 consecutive months, and the 10-year Treasury yield has exceeded the key threshold of 0.8%, triggering a chain reaction in the global bond market; the Federal Reserve is faced with the contradictory signals of a 3.7% year-on-year increase in the core PCE price index and unexpected non-farm payroll data, and is caught in a dilemma between "anti-inflation urgency" and "economic soft landing demands", and the market's expectation of the probability of suspending interest rate hikes in June has risen to 89%; at the same time, the Iran-Israel conflict continues to escalate, and the Gaza Strip and Red Sea Index of the Iranian Revolutionary Guards have formed valuation suppression. The resonance effect of the monetary policy shift and geopolitical conflicts is forcing investors to recalibrate their risk models and seek a new balance in asset allocation under the dual impact of interest rate fluctuations and risk aversion.