The Swiss franc soared to a 10-year high, the US dollar hegemony was hit, and global capital poured into gold for safe haven

- 2025年4月15日

- Posted by: Macro Global Markets

- Category: News

The Swiss franc soared to a 10-year high, the US dollar hegemony was hit, and global capital poured into gold for safe haven

The logic behind exchange rate fluctuations

Geopolitical risk premium: A sudden coup in the Syrian capital Damascus, the continued stalemate in the Russia-Ukraine conflict, and the comprehensive escalation of the trade war between China, the United States and Europe have boosted the demand for the Swiss franc as a "safe currency" due to the market's risk aversion sentiment. Data from the Swiss National Bank showed that on April 10, Swiss franc trading volume in the interbank market surged 380% year-on-year.

Policy differentiation: The Swiss National Bank maintains a negative interest rate policy (-0.75%), but supports its currency by selling foreign exchange reserves (the scale of intervention in a single day reached 12 billion Swiss francs), which is in sharp contrast to the Federal Reserve's "protracted war of high interest rates."

Technical breakthrough: The Swiss franc/dollar exchange rate broke through the long-term resistance level of 1.20 after the 2015 "decoupling from the euro" crisis, triggering follow-up buying of algorithmic trading, further amplifying the gains.

Market Impact

Exporters under pressure: The Swiss watch industry (accounting for 12% of total exports) faces compressed profit margins due to the appreciation of the Swiss franc, and Swatch Group's share price fell 4.7% in a single day.

Cross-border capital flows: Eurozone funds flowed into Swiss government bonds at an accelerated pace, with the yield on 10-year Swiss franc government bonds falling to -0.35%, a record low.

2. The Collapse of US Dollar Hegemony: From “Confidence Crisis” to “System Reconstruction”

The U.S. dollar has experienced a credit crisis, with the U.S. dollar index falling 12% this year, the largest annual drop since the collapse of the Bretton Woods system in 1971. IMF data shows that the proportion of global central bank reserves in U.S. dollars has dropped from 72% in 1999 to 58%.

Global de-dollarization accelerates

Reconstruction of the settlement system: The transaction volume of the new payment system of BRICS countries surged by 380% year-on-year, and the pilot program of digital RMB cross-border payment was expanded to 47 countries, covering 65% of the world's trade volume.

Commodity decoupling: Saudi Arabia accepts RMB settlement for oil, LME plans to launch a metal pricing system based on gold, and 32% of global crude oil trade has achieved non-US dollar settlement.

Central bank gold buying boom: By 2025, the proportion of global central bank gold reserves will rise to 23%, and the annual gold purchase volume may exceed 1,000 tons. The People's Bank of China increased its gold holdings by 22 tons to 2,250 tons in March.

3. Global capital flight: "transfer of faith" from stocks and bonds to gold

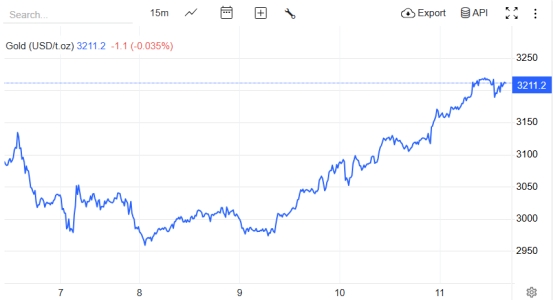

Safe-haven asset carnival: spot gold broke through $3,210 per ounce, up 1.33% in a single day.

Risk Warning: Market fluctuations are driven by policies and sentiment. Investors are advised to formulate strategies based on their own risk tolerance and avoid excessive leverage. The above analysis is for reference only and does not constitute investment advice.