Macro Global MarketsCPI report preview: Market volatility and key turning points in Fed policy

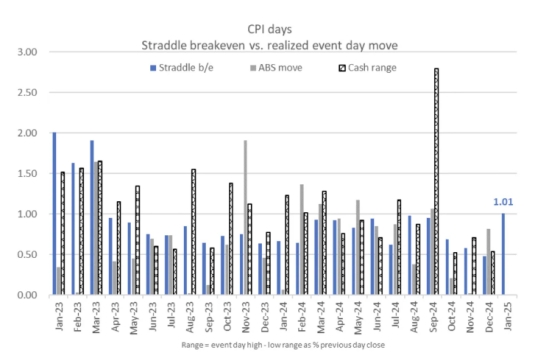

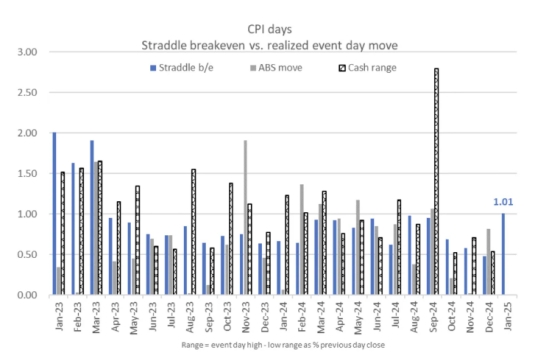

Recent stock market turmoil has options traders increasingly concerned that the upcoming Consumer Price Index (CPI) report could trigger more volatility. Surging bond yields and strong jobs data put the CPI report in the spotlight. Stuart Kaiser, head of U.S. equity trading strategy at Citigroup, said he expects the S&P 500 to move 1% on Jan. 15, up or down, the largest implied volatility on a CPI data release date since the regional bank turmoil in March 2023. .

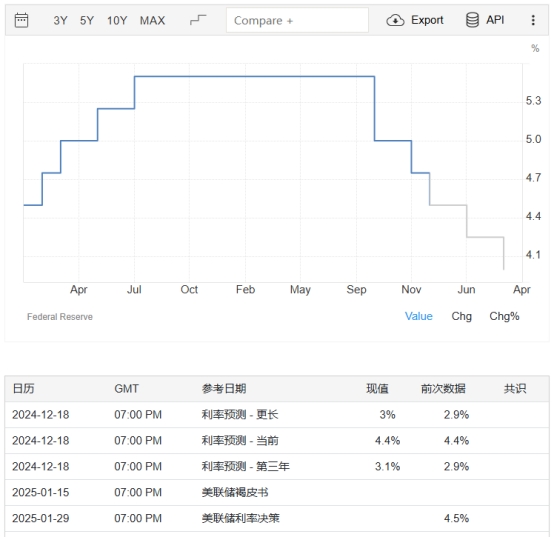

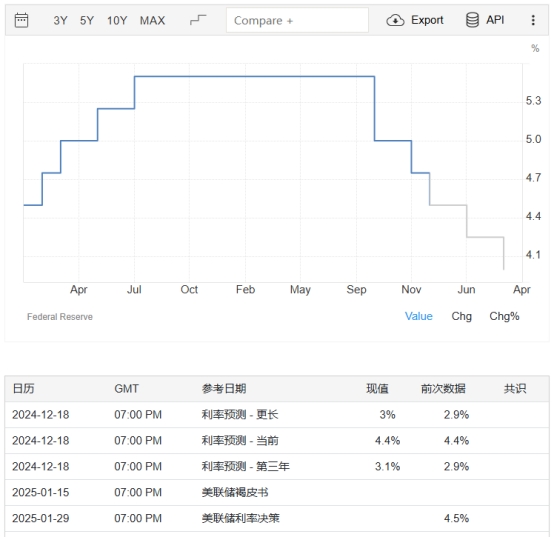

Traders expect the CPI data to provide clarity on the path of interest rate cuts this year. Several large banks have changed their forecasts, expecting the Fed to cut or delay rate cuts. Bank of America now sees no rate cuts from the Federal Reserve this year, a shift in tone that pushed stocks lower at the start of the year.

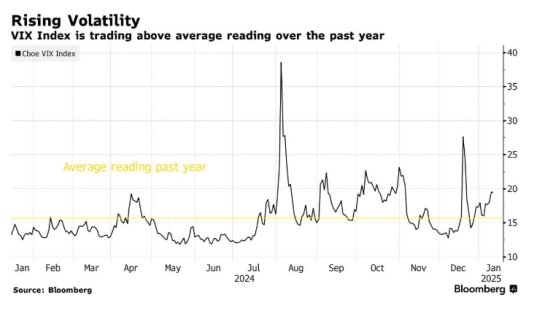

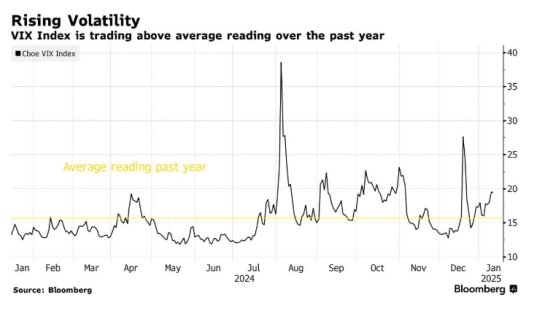

Brent Kochuba, founder of options platform Spot Gamma, said that cooling CPI data could cause the S&P 500 to quickly rise above 5,900, while hot CPI data could cause the S&P 500 to accelerate its decline, which would be consistent with the volatility index ( VIX) has jumped significantly. Concerns about sticky inflation and the Federal Reserve's path to curb inflation have pushed the VIX to 20, showing traders' concerns.

The CPI report will add to the puzzle of data that U.S. traders will need to parse for more clues about the path of the Fed's interest rates. The services index released by the Institute for Supply Management (ISM) on January 7 showed that the indicator measuring the prices of raw materials and services soared to its highest level since early 2023, causing the Nasdaq index to fall 1.8%.

Wednesday's CPI report is scheduled to be released at 9:30 (UTC+8). The core CPI, which excludes food and energy costs, is expected to rise 0.2% month-on-month in December, down from 0.3% in November; the year-on-year growth rate is expected to be 3.3 %, above the Fed's 2% target and unchanged from the previous three months.

Meanwhile, a modest rise in U.S. producer prices for December was unlikely to change the Federal Reserve's view that it will not cut interest rates again before the second half of this year given the strong job market. The U.S. PPI annual rate in December was 3.3%, lower than the expected 3.4%, but up from the previous value of 3%, setting a new high since February 2023. PPI is a leading indicator of CPI and accounts for the majority of the overall CPI. A weaker-than-expected reading tends to be bearish for the dollar as it suggests manufacturers are unable to pass on higher costs to consumers.

With the job market remaining resilient and economic growth solid, U.S. core inflation is likely to cool only slightly by the end of 2024, supporting the Federal Reserve's stance of slowing rate cuts. According to economists' forecasts, the core CPI, which excludes food and energy, is expected to slow to 0.2% in December after rising 0.3% month-on-month for four consecutive months, and the year-on-year growth rate is the same as the reading three months ago. 3.3%, indicating that anti-inflation progress has stagnated.

The recent blowout jobs report has led economists to generally believe that the Federal Reserve will cut interest rates further this year only if inflation shows signs of cooling in the coming months. As of Tuesday morning, markets were pricing in just a 3% chance that the Fed would cut rates at its January meeting, according to the CME’s FedWatch tool. At least before the June meeting, the market believed that the probability of the Fed cutting interest rates at the meeting was no more than 50%.

Market volatility and economic data releases will continue to influence investor sentiment and the Federal Reserve's policy decisions. CPI and PPI data will provide the market with important clues about inflation and economic health, while the performance of the job market will further affect the Fed's path of interest rate cuts. Investors need to pay close attention to these key data in order to respond to possible market fluctuations and policy changes.