Trump warns at NATO summit that Israel-Iran conflict may break out again, risk aversion in gold market heats up

- 2025年6月27日

- Posted by: Macro Global Markets

- Category: News

Trump warns at NATO summit that Israel-Iran conflict may break out again, risk aversion in gold market heats up

Trump's warning was not groundless. Although he announced on June 24 that Israel and Iran had reached a ceasefire agreement, the actual situation is still turbulent: the Israeli military continued to launch air strikes on a radar facility in Tehran after the ceasefire, and Iran launched ballistic missiles at Israel in response. Trump emphasized at the NATO summit that the United States has "completely destroyed" Iran's nuclear facilities and warned that if Iran restarts its uranium enrichment program, it will launch another attack. He also revealed that US and Iranian officials will hold talks next week, but repeatedly stated that such an agreement is "not necessary."

This "hard and soft" strategy reflects the United States' war-like conflicts in the Middle East: on the one hand, it curbs Iran's nuclear program through military deterrence, and on the other hand, it tries to exert pressure through negotiations. However, the Iranian Foreign Ministry explicitly denied that any ceasefire agreement had been reached, only saying that "if Israel stops its aggression, Iran has no intention of continuing to fight back." This difference in position makes the situation full of uncertainty, and the market's concerns that the conflict may escalate at any time continue to ferment.

II. Potential risks and market impact of the Israel-Iran conflict

1. Repricing of geopolitical risk premium

If the Israeli-Iranian conflict breaks out again, it may trigger multiple chain reactions:

Energy supply crisis: Iran’s parliament once considered closing the Strait of Hormuz. If this “choke point” for global oil transportation is blocked, Brent crude oil prices may soar to $120-130 per barrel, exacerbating global inflationary pressures.

Risk of nuclear facility attack: Although the US airstrike on Iran's Fordow nuclear facility was called "complete destruction" by the US, leaked intelligence shows that its underground part was not destroyed, and Iran may have secretly transferred its enriched uranium stockpile. If the conflict escalates, the attack on the nuclear facility may trigger wider regional turmoil.

Expansion of proxy wars: Iran-backed Houthi rebels, Lebanese Hezbollah and other forces may join the conflict, causing the situation in the Middle East to spiral out of control.

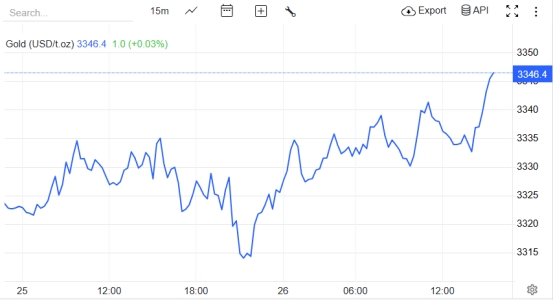

These risks directly boost the safe-haven demand for gold. Historical data shows that the average increase in gold prices can reach 5.5% in the 8-20 trading days after a geopolitical crisis. The current stabilization of gold around $3,300 has partially reflected the market's hedging demand against escalating conflicts.

2. Immediate reaction of the gold market and capital flow

Support from a weaker dollar: The dollar index fell to a four-year low, making gold more attractive to investors holding currencies such as the euro and pound.

Long-term support for central bank gold purchases: China's central bank has increased its gold holdings for seven consecutive months, with holdings increasing to 73.83 million ounces, indicating institutional investors' demand for strategic allocation of gold.

However, there are differences in the market: some speculative funds withdrew from the gold market after the ceasefire agreement was announced, and the gold ETF holdings decreased by 12.3 tons on June 24, while long-term investors gradually built positions around $3,300. This "long-short game" kept the gold price volatile before the data was released.

3. Expert opinions and risk warnings

Institutional analysis: Michael Feroli, chief economist of JPMorgan Chase, pointed out that the escalation of conflict in the Middle East may push up inflation expectations, and gold will benefit as an anti-inflation tool.

Citi analysts predict that if the Strait of Hormuz is blocked, gold prices may break through $3,400 an ounce, but are bearish in the long term and are expected to fall to the $2,500-2,700 range.

Yang Delun, chief economist of Qianhai Kaiyuan Fund, believes that the weakness of the US dollar and the central bank's gold purchases will form long-term support, and the medium- and long-term upward trend of gold will remain unchanged.

Trump's remarks at the NATO summit have reignited market concerns about the Israeli-Iranian conflict, and gold has once again become a "crisis thermometer". In the short term, the repricing of geopolitical risk premiums and the weakening of the US dollar provide support for gold prices, but the medium- and long-term trend still depends on the Fed's policies, geopolitical evolution and the outlook for the global economy.