Historic negotiation window opens: Trump brokers ceasefire between Russia and Ukraine

- 2025年5月21日

- Posted by: Macro Global Markets

- Category: News

On May 19th local time, US President Trump and Russian President Putin held a two-hour telephone conversation and held intensive consultations on a ceasefire in the Russia-Ukraine conflict. After the call, Trump said Russia and Ukraine would "immediately begin negotiations aimed at ending the war" and revealed that the Vatican had agreed to host the talks. Putin later confirmed through a Kremlin statement that Russia was ready to draft a memorandum on a peace agreement with Ukraine and resumed direct contact between the Istanbul negotiators. This breakthrough caused the spot gold price to fall from a high of $3,245 per ounce to around $3,220 in early Asian trading on May 20, a drop of 0.3%. The market's pricing of the geopolitical risk premium dropped sharply from $32 per ounce to $18 per ounce.

Negotiation framework emerges

特朗普在社交媒體披露,普京在通話中提出“技術性停火”方案,要求烏克蘭撤出庫爾斯克地區武裝分子作為談判前提。 儘管澤連斯基隨後表態“不會在領土問題上妥協”,但烏方已同意與俄方就停火備忘錄展開討論,並考慮在土耳其、梵蒂岡等中立地點重啓談判。 值得注意的是,俄方此次未設定“去軍事化”等前置條件,被市場解讀為戰畧妥協。

Undercurrent of European Gambling

After talking with Putin, Trump quickly had intensive communications with Zelensky, European Commission President von der Leyen, and leaders of France, Germany, Italy and other countries. The EU has made it clear that it will continue to support Ukraine and stressed that its "determination to impose sanctions on Russia will not waver." This difference in the positions of the United States and Europe may lead to cracks in the implementation of the ceasefire agreement. German Chancellor Merz has hinted that if Russia fails to fulfill its ceasefire commitment, the EU will expand the scope of its energy embargo on Russia.

Potential pitfalls of a ceasefire agreement

The ceasefire agreement proposed by Russia contains three key clauses: ① Establishment of a 20-kilometer-wide Kursk demilitarized zone; ② Ukraine's commitment not to join NATO; ③ The West lifts financial sanctions on Russia. Analysts pointed out that these clauses are actually a "watered-down version" of the 2022 Istanbul negotiation draft, but nationalist forces in Ukraine may strongly oppose the demilitarization clauses, and the EU's resistance to lifting sanctions cannot be ignored.

2. The bull-bear struggle in the gold market

The short-term impact of geopolitical easing

The rapid decline in geopolitical risk premium directly suppressed gold prices. During the Asian session on May 20, spot gold once fell to $3,204.58 per ounce, hitting a new low since May 16, and had previously shown a V-shaped trend. This "sharp drop and sharp rise" trend reflects the market's doubts about the actual effectiveness of the ceasefire agreement - Israel's "Gideon's Chariot" operation in the Gaza Strip is still ongoing, hitting more than 670 targets, providing some safe-haven support for gold.

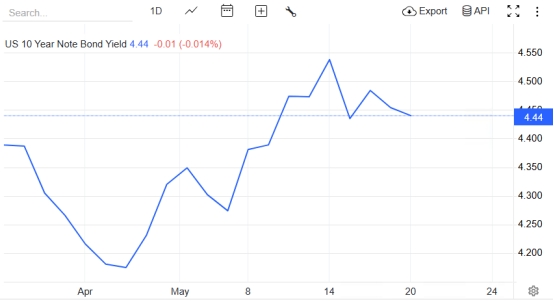

Federal Reserve officials have recently been sending out hawkish signals intensively. New York Fed President Williams said that "we have not seen a large-scale withdrawal of funds from US dollar assets." The market's expectations for the first interest rate cut have been postponed from June to September, and the annual interest rate cut has been reduced to 56 basis points. This policy shift caused the 10-year Treasury yield to rise to 4.449%, suppressing gold's non-interest-bearing asset content. But on the other hand, the U.S. Conference Board leading index monthly rate in April was -1%, the largest drop since March 2023. The signal of economic slowdown provides support for expectations of interest rate cuts.

Goldman Sachs Group: It is recommended to adopt a "cross-market arbitrage" strategy, buying gold ETFs (GLD) while shorting S&P 500 index futures (SPX) to hedge against the rebound in risky assets caused by geopolitical easing.

Morgan Stanley: Maintains a "neutral" rating on gold, with a target price of $3,200-3,260 per ounce, and believes that the uncertainty of the ceasefire agreement may cause fluctuations of around 3%.

The secret talks between Trump and Putin brought a long-awaited ray of peace to the Russia-Ukraine conflict, but the specific terms and enforcement of the ceasefire agreement are still full of uncertainty.