Trump wields the tariff stick again, imposing a 25% tariff on all imported cars, causing turmoil in the gold market

- 2025年3月28日

- Posted by: Macro Global Markets

- Category: News

Trump wields the tariff stick again, imposing a 25% tariff on all imported cars, causing turmoil in the gold market

Tariff Policy Content Analysis

According to the documents released by the White House, the tariffs were imposed in the name of "national security" under Section 232 of the Trade Expansion Act of 1962. The scope of the tariffs covers imported cars, SUVs and other passenger cars and light trucks, and key auto parts such as engines and transmissions are also unlikely to be spared. It may be further expanded to other parts in the future. However, under the framework of the US-Mexico-Canada Agreement, if auto importers can prove that their products are made in the United States, they can only impose tariffs on the value of the non-US-made part. Trump stressed that this move will prompt more auto production to return to the United States, open up new sources of revenue for the government, and help reduce national debt.

The stock prices of American automakers fluctuated significantly that day, with GM's stock price falling by about 3%, Ford's stock price remaining basically unchanged, and Stellantis Group, which owns the Jeep and Chrysler brands, falling by nearly 4%. Gary Hufbauer, a senior researcher at the Peterson Institute for International Economics and a former Treasury official, bluntly stated that the tariff policy is a "major blow" to the auto industry, and the soaring cost of automobiles will suppress market demand, especially at a time when consumers are in poor financial condition, and American auto and parts companies may face a crisis of "massive layoffs."

The US allies quickly retaliated. Canadian Prime Minister Mark Carney spoke fiercely, saying that this was a "direct attack" on Canadian workers. The Canadian government will quickly study countermeasures and does not rule out retaliatory tariffs. The European Commission also responded quickly, announcing the imposition of counter-tariffs on US goods worth 26 billion euros (1 euro is about 1.09 US dollars). European Commission President Johannes van der Leyen stressed that the automotive industry is of great significance to innovation, competitiveness and high-quality employment, and the European and American supply chains are deeply integrated. Additional tariffs are not good for American and European companies and consumers. Hildegard Mueller, president of the German Automobile Industry Association, issued a statement saying that the tariffs sent an "extremely negative signal" to global free and rule-based trade, which would severely hit companies and the global automotive supply chain, negatively affect consumers, and also damage the U.S.'s own economic growth and prosperity. Brazilian President Lula also stated that Brazil would not "sit and wait" in the face of Trump's tariff measures, and would take countermeasures that would benefit the country.

Gold market volatility is wide

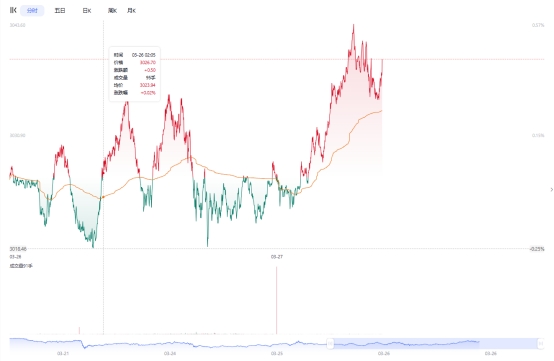

As the global trade situation is changing due to automobile tariffs, the gold market is also significantly affected. On March 26, affected by the news, the gold price bottomed out and rebounded, and then remained volatile. COMEX gold futures rose slightly by 0.02% to $3,026.6 per ounce.

Trump's decision to impose a 25% tariff on imported cars has brought great uncertainty to the global auto industry and the gold market. The market will pay close attention to the specific impact of the policy after it officially takes effect on April 2, as well as the further response of various countries. Investors need to remain highly vigilant and respond prudently to market fluctuations.