Trump's "Liberation Day" tariff policy was ruled unconstitutional, and the global trade pattern is facing reconstruction

- 2025年6月3日

- Posted by: Macro Global Markets

- Category: News

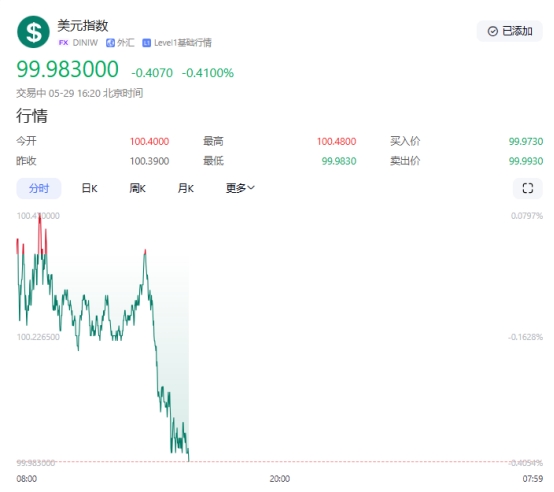

On May 28, local time, the U.S. International Trade Court made a historic ruling, finding that the "Liberation Day" tariff policy announced by the Trump administration on April 2 was overstepping its authority, and ruled that the president had no right to impose comprehensive tariffs on trading partners. This ruling not only directly impacted the foundation of U.S. trade policy, but also triggered a chain reaction among global trading partners. Major economies such as the European Union and Mexico have already launched retaliatory tariff plans. Affected by this, the spot gold price opened lower in the early Asian session on May 29, plummeting by $30 to $3,261.27 per ounce, a new low since May 22, and the U.S. dollar index soared to 99.98, causing violent shocks in global financial markets.

The U.S. International Trade Court clearly pointed out in its ruling that the Trump administration's use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs exceeded the constitutional authority granted to the president, and that Congress is the only institution with the power to formulate trade policies. The court held that the trade deficit itself does not constitute a national emergency, and the president has no right to unilaterally launch a global trade war on this basis. This is the first major legal challenge to Trump's tariff policy. If the ruling is ultimately upheld, it will directly undermine the core foundation of his protectionist trade policy. Although the Trump administration has filed an appeal and asked the Federal Circuit Court of Appeals to suspend the implementation of the ruling, the court gave the executive branch up to 10 days to stop imposing tariffs, significantly reducing policy uncertainty in the short term.

2. Global response: Risks of “revolt” from trading partners escalate

EU: Retaliatory tariffs are imminent

The European Commission has initiated legal procedures for imposing additional tariffs on US goods, and plans to implement reciprocal countermeasures on US agricultural products and industrial equipment worth 95 billion euros. German Economy Minister Habeck said, "The US's attempt to reshape trade rules through unilateral tariffs has violated international law, and the EU will resolutely defend its own interests." Trump's threat to impose a 50% tariff on EU goods has led to a full-scale decline in European stock markets, with the French CAC40 index and the German DAX index both falling by more than 1%.

Mexico: Legal and economic counterattack

The Mexican Ministry of Foreign Affairs announced that it will file a complaint with the WTO together with Canada, requesting a ruling that the US tariff policy violates international trade rules. At the same time, the Mexican Ministry of Economy has drawn up a list of goods exported to the US, and plans to impose 15%-25% tariffs on US agricultural products, auto parts, etc., involving a trade volume of more than US$20 billion. Mexican President Lopez stressed that "we will not sit idly by and watch the US undermine the stability of the North American supply chain, and will take all necessary measures to protect our domestic industries."

China: Urges the US to return to the multilateral framework

A spokesperson for China's Ministry of Commerce said that China has always opposed unilateralism and protectionism and urged the United States to respect the rule of law and international trade rules. Although the ruling did not directly involve tariffs on China, analysts pointed out that if the legal basis of the US trade policy is shaken, it may create new opportunities for Sino-US economic and trade negotiations.

3. Gold market: risk aversion recedes

Price crash and capital withdrawal

The news of the suspension of the tariff policy led to a rapid recovery in market risk appetite, and funds accelerated the withdrawal from safe-haven assets such as gold. In the early Asian session on May 29, spot gold fell below the $3,300/ounce mark at the opening, reaching a low of $3,261.27/ounce, a sharp drop of $30 from the previous trading day's closing price, a drop of 0.91%, and trading volume surged by 219,000 lots to 455,000 lots, a new high in nearly a month. At the same time, the US dollar index soared 0.35% to 99.90, and the US Treasury yield climbed to 4.45%, further suppressing the attractiveness of gold.

4. Subsequent risks: policy reversals and geopolitical black swans

Although the Trump administration has filed an appeal, legal experts pointed out that if the Federal Circuit Court of Appeals upholds the original ruling, Trump may instead invoke Section 301 of the Trade Act or promote congressional legislation to try to bypass constitutional restrictions and restore the tariff policy. Such policy reversals may cause drastic market fluctuations.

The situation in the Middle East remains tense, and Israel's military operations in Gaza and Iran's uranium enrichment activities may still ignite safe-haven demand at any time. In addition, geopolitical risk points such as the escalation of the Russian-Ukrainian conflict and changes in the situation on the Korean Peninsula may become the fuse for the rebound of gold prices.

The legal crisis of Trump's "Liberation Day" tariff policy has not only triggered a dramatic adjustment in the gold market, but is also likely to reshape the global trade pattern. The current market has entered a short-dominated phase, and operations should follow the trend and wait for rebound short-selling opportunities. At the same time, we must be vigilant about the uncertainties brought about by geopolitical and policy changes, and strictly set stop losses to protect the principal. In the coming week, investors need to focus on the US core PCE price index, speeches by Fed officials, and developments in the Middle East, as these factors will determine the short-term direction of the gold market.