Trump once again blasted Powell as "stupid and incompetent"! The gold market is facing a long-short game

- 2025年5月12日

- Posted by: Macro Global Markets

- Category: News

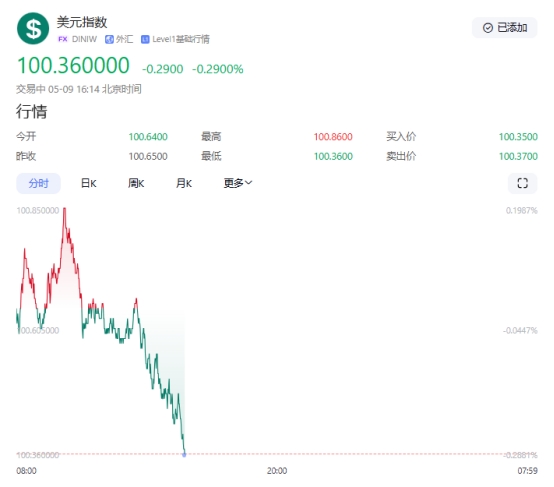

U.S. President Trump once again blasted Federal Reserve Chairman Powell on social media on Thursday (May 9), calling him "stupid and incompetent" and accusing the Fed of being "slow to act" and failing to cut interest rates in a timely manner to cope with downward economic pressure. At the same time, the framework of the trade agreement reached by the United States and the United Kingdom on May 8 sent a signal of easing global trade frictions. The U.S. dollar index jumped 1.03% to 100.639 on the same day, hitting a nearly one-month high, further suppressing market expectations for the Federal Reserve to cut interest rates.

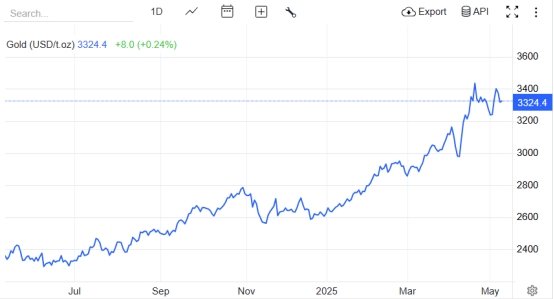

Affected by this, the international gold price fell below $3,280 per ounce during the Asian session on May 9, but then rebounded to around $3,300. As of press time, the spot price of London gold was $3,324.4 per ounce, up 0.24% from the previous trading day.

Trump's latest comments were a direct response to the Federal Reserve's May 7 decision to keep interest rates unchanged. At the monetary policy meeting that day, the Federal Reserve maintained the target range for the federal funds rate at 4.25%-4.50% for the third consecutive time, and emphasized that "inflation pressure still needs to be observed." Powell mentioned "tariffs" 20 times at the press conference and said "the cost of waiting and watching is quite low," suggesting that the Fed will continue to evaluate the impact of Trump's tariff policy on the economy.

This stance completely angered Trump. He called Powell a "fool" on social media and sarcastically said that "talking to the wall is more meaningful than communicating with him." Vice President Pence also supported Trump in an interview with Fox News, saying that Powell was "wrong about almost everything" and accusing him of failing to effectively deal with the economic shocks brought about by inflation and trade policies. Analysts point out that Trump's continued pressure is aimed at diverting public attention from the economic uncertainty caused by his tariff policy and creating an image of an "economic savior" for the 2026 election.

2. The US-UK trade agreement sends a signal of easing, and the game between the US dollar and gold intensifies

The framework of the US-UK trade agreement reached on May 8 became another focus of market attention. According to the agreement, the United States will impose a 10% tariff on the first 100,000 cars exported from the UK, and maintain a 25% tariff on the excess; the UK agreed to expand market access for US agricultural products such as beef and ethanol. Although the details of the agreement still need to be finalized, the market generally believes that this is the first substantive breakthrough in Trump’s “reciprocal tariff” policy, and may provide a template for subsequent negotiations with economies such as the European Union and Japan.

The US dollar index soared 1.03% on the day, hitting a nearly one-month high, but fell back to 100.36 today. The strengthening of the US dollar directly suppressed the attractiveness of gold denominated in US dollars. Spot gold plummeted 1.74% on May 8, falling below the $3,300 mark. However, the "limitations" of the agreement have also aroused market doubts: the United States has not abolished the 10% base tariff, and British car exports are still subject to quota restrictions, and the long-term risks of trade frictions have not been completely eliminated.

Trading strategy: For details, please see the column "Exclusive Views"

Risk warning: Be wary of the Federal Reserve’s “hawkish surprises” (such as CPI exceeding 3.5%), Trump’s repeated tariff policies, and escalating conflicts in the Middle East.

The escalation of the conflict between Trump and the Federal Reserve and the implementation of the US-UK trade agreement have caused the gold market to face a "strong dollar and weak gold" pattern in the short term. However, central bank gold purchases, expectations of Federal Reserve rate cuts and the long-term existence of geopolitical risks still provide a "safety cushion" for gold prices. Investors need to closely follow the US CPI data on May 13 and Trump’s policy trends and seize opportunities between “policy games” and “risk aversion pulses”. In a market environment dominated by uncertainty, gold's status as the "ultimate safe-haven asset" may be further consolidated.