Trump boasts that tariff threats are effective: EU accelerates negotiations, bull-bear game intensifies in gold market

- 2025年5月29日

- Posted by: Macro Global Markets

- Category: News

On May 27, US President Trump claimed on social media that his threat to impose a 50% tariff on the EU "worked", saying that the EU had taken the initiative to request to speed up the trade negotiations. This statement came from the fact that after Trump suddenly escalated his tariff threat last week, European Commission President von der Leyen urgently called for negotiations, which eventually prompted Trump to postpone the implementation of tariffs from June 1 to July 9. However, market concerns about trade frictions have not completely dissipated, and gold prices have fluctuated under the interweaving of long and short factors.

Trump's maximum pressure strategy

On May 23, Trump accused the EU of "setting up trade barriers and manipulating currencies" on social media and announced a 50% tariff on EU goods from June 1, triggering a sharp drop in European and American stock markets. The Euro Stoxx 50 index fell 2.1% that day, the German DAX index fell more than 2%, and the three major US stock index futures fell more than 1% before the market opened.

This threat is seen as a continuation of Trump's "maximum pressure" strategy. Since the United States imposed a 25% tariff on EU steel and aluminum products in March 2025, the negotiations between the two sides have been deadlocked. Trump's escalation of tariff threats this time is aimed at forcing the EU to make concessions in areas such as industrial product tariffs and agricultural product market access.

EU's emergency mediation and postponement

Faced with Trump's tough attitude, European Commission President Ursula von der Leyen took the initiative to call Trump on May 25 and promised to "quickly advance negotiations." Subsequently, Trump announced that the implementation of tariffs would be postponed to July 9, which coincides with the original expiration date of the "reciprocal tariff" suspension.

EU Trade Commissioner Šefčović will meet with US Trade Representative Greer in Paris on June 4 to focus on tariffs in key areas such as steel, aluminum, and automobiles. The EU also proposed a revised trade proposal, including mutual reductions in industrial product tariffs and additional purchases of US soybeans and liquefied natural gas, but it was previously rejected by the United States.

Trump's boast

On May 27, Trump posted on the social network Truth, saying, "The EU has called and asked to set a date for the talks as soon as possible, which is a positive sign." He stressed that if the negotiations fail to reach a fair agreement, he will reserve the right to impose additional tariffs.

2. Gold market: Short-term risk aversion demand weakens temporarily

Trump's decision to postpone the implementation of tariffs has temporarily eased market concerns about an immediate escalation of trade frictions. On May 28, the U.S. Consumer Confidence Index in May rebounded sharply from 85.7 in April to 98, a three-month high, indicating that economic resilience has increased and the attractiveness of risky assets has increased.

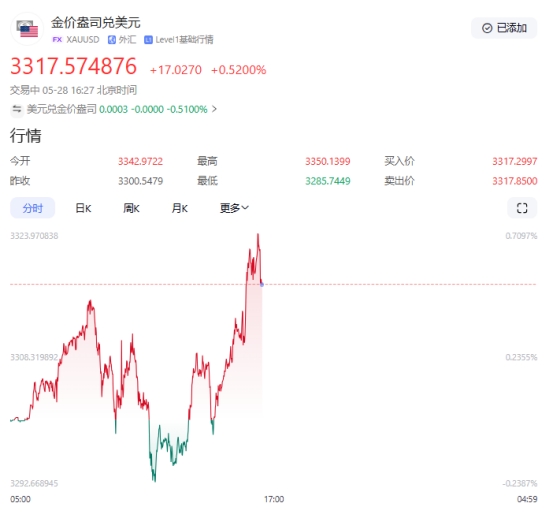

Affected by this, the short-term safe-haven demand for gold has cooled down, falling to the 3,300 mark yesterday, and then a small part of the pullback today, rising to around $3,317 for fluctuations. However, the market is still wary of the repetitiveness of Trump's policies - historical data shows that Trump has repeatedly "reversed his words" in trade negotiations, for example, he postponed the implementation date of tariffs on China three times in 2024.

The market needs to pay close attention to the progress of the EU-US trade negotiations on June 4. If the two sides make breakthroughs in areas such as automobile tariffs and agricultural product exports, it may further boost risk appetite and suppress gold prices; on the contrary, if the negotiations fail, the escalation of trade frictions will drive gold prices to rebound.

In addition, economic indicators such as the U.S. durable goods orders data for May (expected to fall 6.3% month-on-month) and the Richmond Fed Manufacturing Index for May will be released this week. If the data is weak, it may exacerbate market concerns about an economic recession and support the safe-haven demand for gold.

Trump's tariff threat and the EU's compromise game highlight the fragility of the global trade pattern. Although the rebound in market risk appetite in the short term has suppressed gold prices, in the long run, the uncertainty of trade frictions, geopolitical risks and the expectation of the Fed's interest rate cut still provide solid support for gold. Investors need to pay close attention to the progress of negotiations between Europe and the United States and changes in economic data, and flexibly adjust their positions to cope with market fluctuations.