Israel's "Gaza Comprehensive Control Plan" broke out! Gold prices soared, and geopolitical risk premiums continued to expand

- 2025年5月7日

- Posted by: Macro Global Markets

- Category: News

1. Live Report: The Dual Impact of Military Occupation and Civilian Migration

On May 5th local time, the Israeli Security Cabinet formally approved the "Gideon Chariot" military plan, announcing that it would implement a full occupation of the Gaza Strip and forcibly relocate 2.3 million civilians to the southern region. This strategic shift marks Israel's transition from "short raids" to "long-term presence". The Israeli army has mobilized tens of thousands of reserve soldiers and plans to launch operations immediately after US President Trump ends his visit to the Middle East. According to the plan, the Gaza Strip will be divided into 6-10 "security zones" controlled by American private security companies. The right to distribute aid materials will be entirely taken over by the Israeli military, and international organizations such as the United Nations will be excluded.

UN Secretary-General Guterres urgently condemned the plan, saying it would lead to an "irreversible humanitarian disaster". 90% of Gaza's population has been displaced and the fate of 59 hostages is unknown. The European Commission urged Israel to exercise restraint, and China's permanent representative to the United Nations, Fu Cong, stressed that "any attempt to change the demographic structure of Gaza is a violation of international law." The US National Security Council expressed support for Israel's actions, saying that Hamas was fully responsible for the conflict. This move was interpreted as paving the way for the Trump administration's "clear Gaza" plan.

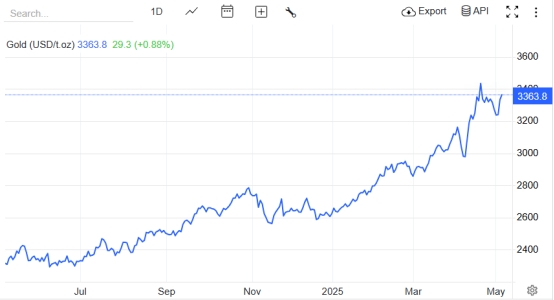

3. Gold market: safe-haven buying pushes prices above key resistance

Affected by the surge in geopolitical risks, spot gold jumped higher in the Asian session on May 6, reaching a high of $3,386.59 an ounce, up 1.6% from the previous closing price, setting a new high since the conflict in October 2023. The technical side shows that the gold price has broken through the key resistance of $3,300/ounce, the daily MACD golden cross has formed, and the red momentum column has expanded, confirming the bullish trend. The hourly line oscillates upward along the 20-day moving average. The 15-minute chart pullback did not break the support of $3,305/ounce, and the bullish momentum is strong.

Geopolitical risk premium: The conflict between Israel and Hamas has resulted in 52,000 deaths. If full occupation leads to intervention by regional countries, it could trigger the "Sixth Middle East War." Historical data shows that similar crises usually drive gold prices up by more than 5% per month.

Federal Reserve policy expectations: The market's probability of keeping interest rates unchanged at the May 7 interest rate meeting is as high as 97.2%, but if Powell sends a "dovish" signal, expectations of a rate cut will further boost gold prices. The current US dollar index fell 0.25% to 99.79, providing support for gold.

Israel's plan to "fully annex Gaza" marks a fundamental reshaping of the geopolitical landscape in the Middle East. The humanitarian crisis and regional conflict spillover risks it has triggered are pushing gold to the core position of a "war-fighting safe-haven asset." From a medium- to long-term perspective, the "permanent conflict" in the Middle East will reshape global energy and trade routes. Coupled with the "slow variables" of the Federal Reserve's policy shift, gold's financial content and anti-inflation function are forming a dual valuation anchor.