December Non-Farm Employment Report Outlook - In-depth Analysis of Market Expectations and Potential Impacts

- 2025年1月14日

- Posted by: Macro Global Markets

- Category: News

December Non-Farm Employment Report Outlook - In-depth Analysis of Market Expectations and Potential Impacts

Non-agricultural forecast outlook

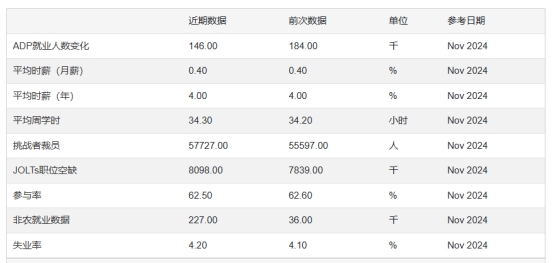

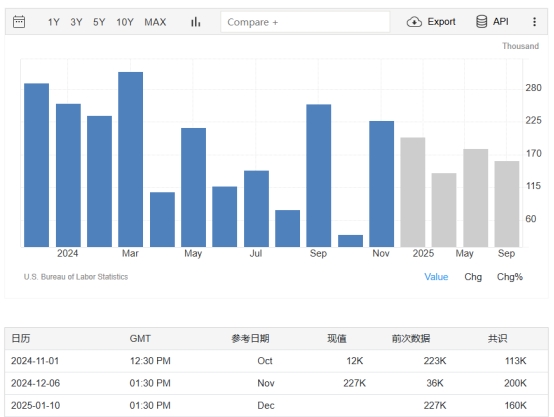

The United States is about to release a series of key labor market data, among which the December non-farm payrolls report on January 10 is bound to attract much attention. Analysts generally expect that the December non-farm data will no longer be affected by special factors in previous months (such as hurricanes and strikes), and will more accurately reflect the actual situation of the current labor market, and may have an important impact on the Federal Reserve's monetary policy. At present, the market predicts that the median number of new non-farm payrolls in the United States in December will be 160,000, a decrease from 227,000 in November, and the unemployment rate is expected to remain at around 4.2%, and the year-on-year growth rate of average hourly wages is also expected to remain at 4%.

(2) Non-farm data exceeded expectations: The US job market is good, which is bullish for the US dollar and bearish for gold.

Interpretation of non-agricultural forecast

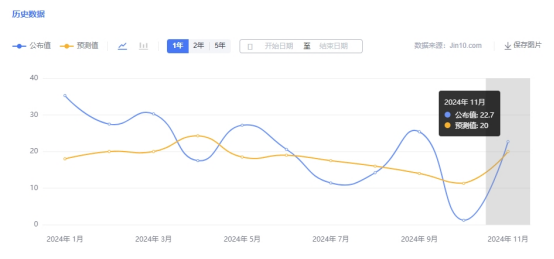

Looking back at past non-farm data, the US non-farm data in September was strong, with 254,000 new jobs and the unemployment rate falling to 4.1%, while the number of new jobs in October was only 12,000, and the unemployment rate was the same as the previous value, also at 4.1%. Against this background, the Fed's policy direction is still wavering, and they emphasize that the path of interest rate cuts must be "data-driven". Although the October non-farm data did not meet expectations, policymakers' positions remain firm and have not revealed whether they support a rate cut this month.

This week may be extremely important for the market to start the year. Wall Street traders will pay close attention to Friday's December non-farm report, hoping that it will show that the US job market is stable but not overheated, providing support for the rise of the stock market in 2025. Industry insiders generally believe that whether the US stock market can perform well for the third consecutive year depends in part on the performance of the US economy in the new year, and labor market data is one of the key indicators to measure the health of the economy.

UBS said in its latest report that it expects the number of new jobs in December to be close to the recent average, indicating that the labor market is gradually cooling down, providing room for the Federal Reserve to cut interest rates. Weak data may strengthen market expectations of interest rate cuts, while if the data is stronger than expected, it is not expected to push the US dollar index down significantly.

ING Bank does not expect the labor market to deteriorate rapidly, but only gradually, which is consistent with the Fed's cautious approach to easing. After the hawkish tilt of the dot plot in December, a rate cut in January does require a series of data that sounds like a recession. The bank expects that if there is a short-term correction, the US dollar will be strongly bought on the decline. Macro and political factors continue to point to the 110 mark for the US dollar index.

ECB President Christine Lagarde recently said that if the upcoming data continues to confirm their baseline view, more interest rate cuts will be implemented. ECB research estimates that the neutral interest rate is between 1.75% and 2.5%. Ischnabel, an influential hawk within the ECB, also said: "Given the risks and uncertainties we still face, gradually lowering the policy interest rate to a neutral level is the most appropriate course of action."

Non-agricultural policy impact

The new US Congress is about to officially take office, and according to the schedule, US President-elect Trump will be sworn in on January 20. Against the backdrop of Trump's upcoming inauguration, if the December non-farm report shows a strong labor market, Trump may be more confident in implementing his economic policies. These policies may have new impacts on the US labor market, inflation levels and economic growth, thereby increasing the complexity and uncertainty of the Fed's decision to cut interest rates.

Divisions within the Republican Party could threaten Trump's agenda of lowering taxes, increasing tariffs and restricting immigration. The Federal Reserve will release minutes from its December meeting this week. Investors have lowered their expectations for a U.S. interest rate cut in 2025, with Trump's proposals likely to put upward pressure on inflation. U.S. money markets are pricing in just over 40 basis points of rate cuts this year, the equivalent of just two.

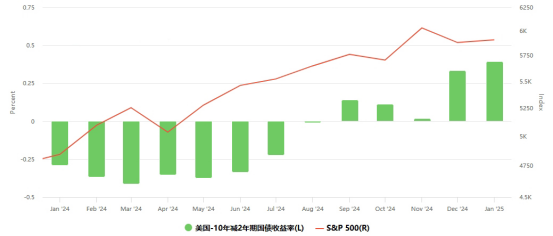

Market dynamics before non-farm payrolls

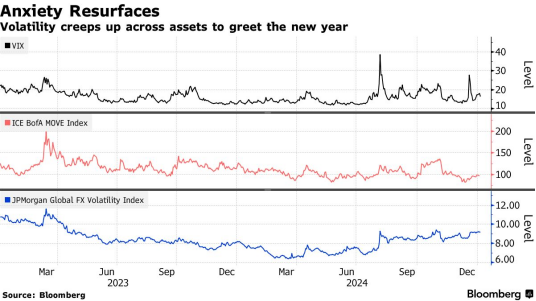

The turning of the calendar is a good opportunity to look forward to the future, but for Wall Street in the new year, the future seems a little foggy. Although the U.S. market sentiment was high last Friday, for most of the time after Christmas, traders have converged the strong risk appetite that dominated the market for most of 2024, and the volatility of U.S. bonds and corporate credit assets has quietly increased; the stock market has also suffered one of the worst year-end declines in history; the spot ETFs of Bitcoin, which are loved by global speculators, have also experienced the worst outflow of funds in history.

But from the news perspective, this week may be extremely important for the market to start the year. Wall Street traders will pay close attention to Friday's December non-farm report, hoping that it will show that the US job market is stable but not overheated, thus providing support for the stock market to rise in 2025. In addition, the release of the Federal Reserve minutes and the speeches of several Federal Reserve officials have also attracted much attention from the market.