The war in the Middle East continues to escalate! Israel vows to fight to the end, Trump denies ceasefire

- 2025年6月18日

- Posted by: Macro Global Markets

- Category: News

The war in the Middle East continues to escalate! Israel vows to fight to the end, Trump denies ceasefire

1. Middle East situation: the dual game between Israel’s tough stance and Trump’s policy

1. Israel’s “logic of war” diverges from the international community

The Israeli ambassador's tough statement highlights its strategic intention to "suppress Iran's nuclear capabilities by military means". Although Iran announced on the 17th that it would suspend some missile production activities and restart nuclear negotiations, Israeli Prime Minister Netanyahu said at the cabinet meeting that day that "Iran's promises are worthless and it must be forced to completely abandon its nuclear program through military pressure". This position is in sharp contrast to the EU: When European Commission President von der Leyen spoke with Netanyahu on the 16th, she urged Israel to "immediately allow humanitarian aid to enter Gaza" and stressed the "necessity of resolving the Iranian nuclear issue through negotiations."

During the G7 summit, Trump refused to sign a joint statement calling for a ceasefire between Israel and Iran, sparking dissatisfaction among European allies. French President Macron accused him of "unilateral actions that will only exacerbate the conflict," while Trump responded by saying "Europe should assume more responsibility for Middle East security." After returning to the United States on the 17th, Trump reiterated at a White House briefing that "the United States will not directly intervene militarily, but will isolate Iran through sanctions and diplomatic means." This policy path not only continues his "America First" diplomatic style, but also leaves room for policy uncertainty in the market.

3. Potential risk points for conflict escalation

There are two major flashpoints in the current situation in the Middle East: one is whether Israel's air strikes on Iran's nuclear facilities will be expanded to civilian targets; the other is whether Iran will implement "proxy retaliation" by supporting Lebanon's Hezbollah or Yemen's Houthi armed forces. If the conflict spreads to the Strait of Hormuz, the risk of oil supply disruptions may push up inflation expectations, thereby strengthening the safe-haven content of gold.

2. Gold market: a battleground between geopolitical risks and policy expectations

2. Gold market: a battleground between geopolitical risks and policy expectations

1. Short-term volatility: a tug-of-war between safe-haven buying and profit-taking

Despite the ongoing conflict between Israel and Iran, gold failed to continue its rally on June 16, mainly due to three factors:

Technical pullback demand: The daily RSI index fell from the overbought area to around 65, indicating that the bullish momentum weakened; the Bollinger Bands on the 4-hour chart narrowed, and the gold price ran below the middle track, and the short-term bears had the upper hand.

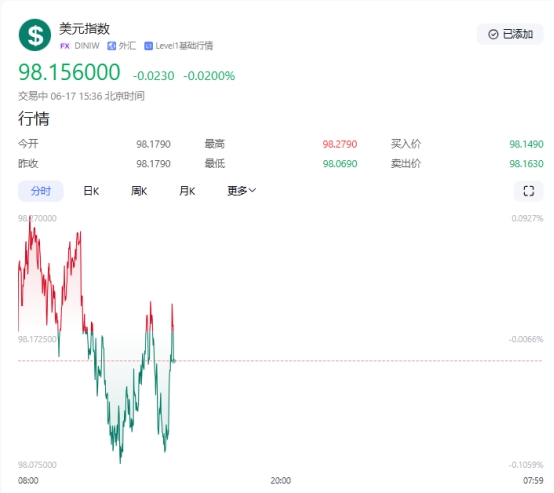

Fed policy expectations diverge: The market's divergence on the Fed's interest rate meeting on June 19 has intensified. CME's "Fed Watch" shows that the probability of keeping interest rates unchanged in June is as high as 99.6%, but the expectation of the number of interest rate cuts this year has been reduced from two to one. The US dollar index rose slightly to 98.15, suppressing the rebound space of gold.

Global central banks continued to increase their gold holdings in the first quarter of 2025, with China's gold reserves increasing to 73.83 million ounces and Kazakhstan's gold reserves increasing by 0.4% month-on-month in May. The European Central Bank report shows that gold has surpassed the euro to become the world's second largest reserve asset, and the central bank's gold purchases in 2024 will exceed 1,000 tons. This structural demand provides long-term support for gold prices, and even if there is a short-term pullback, the downward space is relatively limited.

The current gold market is at a "crossroads" of geopolitical risks and Fed policy expectations. Israel's tough stance and Trump's policy path have exacerbated short-term volatility, but the long-term logic of central bank gold purchases and de-dollarization still provides support for gold prices.